Jump to section

Automotive SEM Snapshot: Who’s Bidding on Ford’s SEM Trademarks?

Each week, The Search Monitor chooses one industry from our list of 1,239 industries for a weekly snapshot of SEM activity. This week, we had two topics that we wanted to cover. So in addition to yesterday’s post on financial aid advertisers, we are focusing this post on automotive advertisers. While the automotive industry is a complex mosaic of brands, regional ad groups, individual dealers, and research sites, we opted to dive into Ford’s SEM activities. In particular, we focused on general SEM metrics for Ford, stats on the industry as a whole, any potential instances of trademark violations, and the very colorful and important Rank Knock-Out Chart.

What We Learned: Trademark Bidding In Action

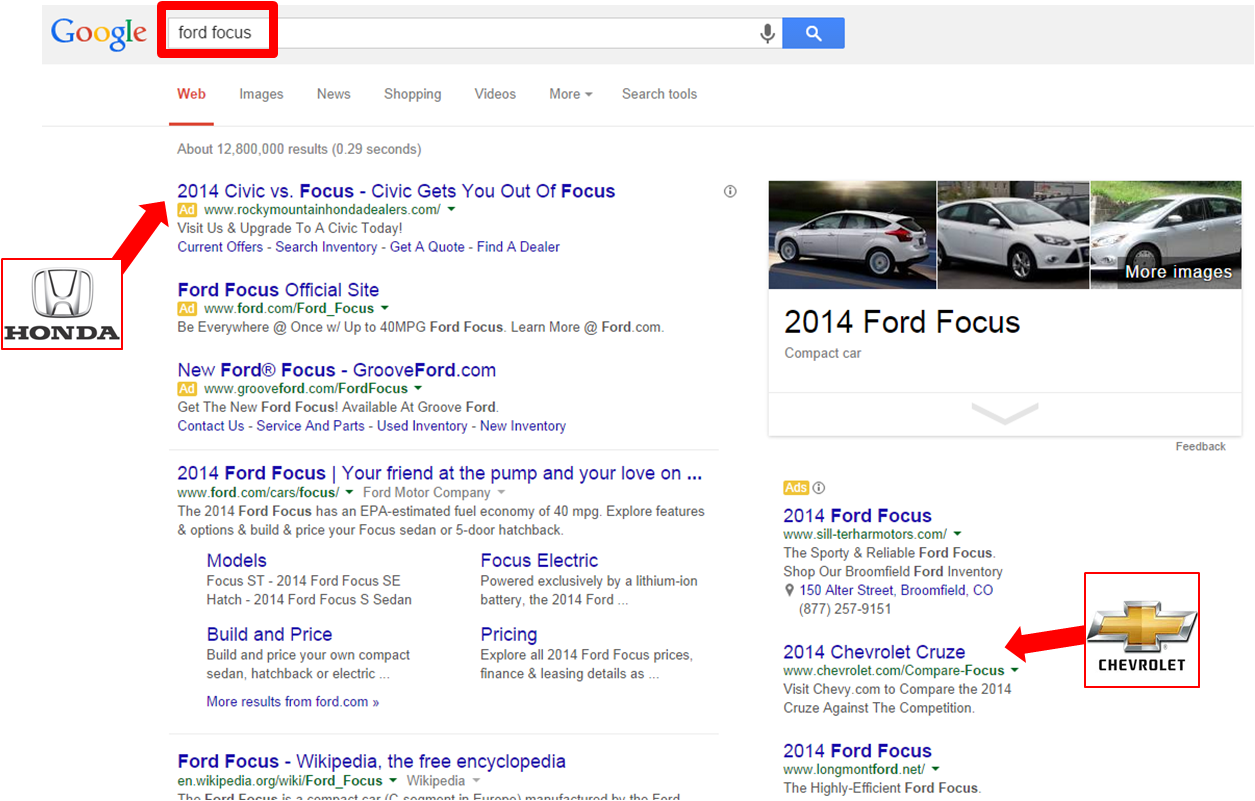

We started our analysis with a simple search on one of Ford’s trademarks, the Ford Focus. We were curious if any of Ford’s competitors were bidding on that term. We found it on our very first search–multiple instances of competitive trademark bidding (see screenshot above). A few things that caught our eye about the search results:

- Both Honda and Chevy have high-ranking ads appearing on a Ford trademark, the Ford Focus.

- Google has no problem when companies do this as long as they focus on helping the searcher by providing comparison resources – notice the URLs. These URLs lead to pages with helpful comparisons.

- In Honda’s and Chevy’s case, they didn’t even mention Ford in their ad copy or URL, just the word Focus.

- What should Ford do to respond? First, they need to know what’s happening by regularly pulling these reports. Next, they can use this ad intelligence to work with their dealers to try to occupy all of the top spots on a page, to bump out competitors. (Ask The Search Monitor for examples of how to do this.)

What We Learned: Trademark Violations

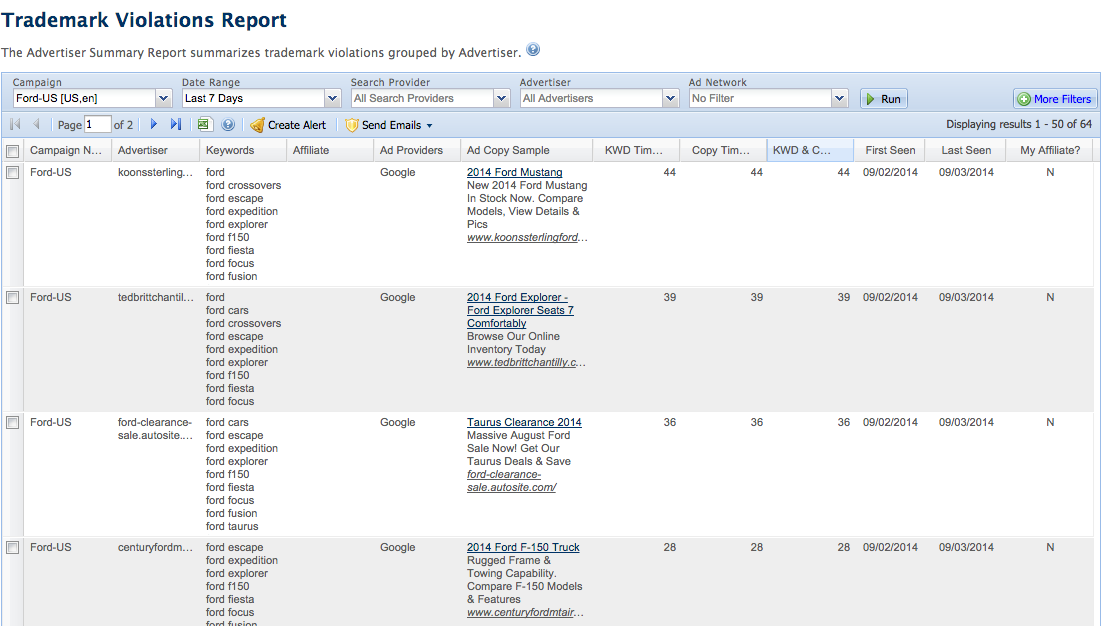

Next, we ran our Trademark Violations Report which produced the table above. For any advertiser and list of trademarked keywords, this report lists other advertisers who are bidding on those keywords and using them in their ad copy. Not every instance on this report is a true violation for the advertiser – we just flag potential violations based on criteria entered by the user. Each advertiser has their own rules for when and how their trademarks can be used by partners, such as local dealers. A few things that caught our eye:

- In just the four instances pictured above, we see 3 local dealers (Koon’s, Tedd Britt, and Century) and the company AutoSite.com running ads on Ford’s branded keywords.

- These instances of ‘trademark violations’ could very well be acceptable by Ford. After all, Ford may want to send traffic to those sites anyway. If these actions are not allowed by Ford because the advertisers were bidding on off-limit keywords during off-limit times or simply out-ranking Ford’s own ads, Ford can use this information to take action.

What We Learned: Overall Industry Metrics

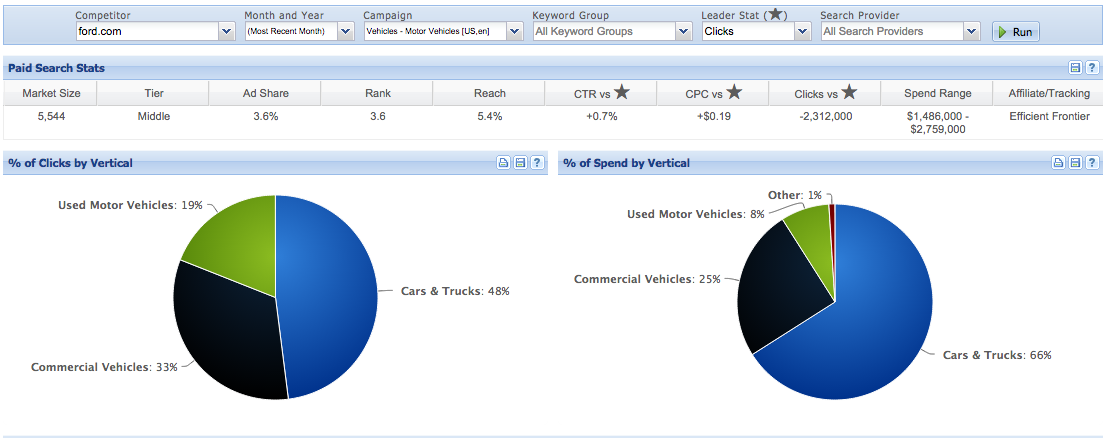

After analyzing trademarks, we wanted to look at top-level industry metrics. The above chart is from our Vertical Ad Spend Summary Report. For any automotive advertiser and vertical, it provides high-level indicators of the SEM activity in that vertical and how the advertiser (in this case Ford) compares. Remember that these numbers come from monitoring just Google in the US over a 3-day period but could easily be expanded to other dates/sites/countries. Here are a few things that caught our eye:

- The number of advertisers in the Motor Vehicles category was approximately 5,500. This was a bit larger than we would have guessed, although it’s likely due to the presence of so many individual dealers. It would be interesting to look at our trend data for this metric to see if there is any significant seasonality in this gauge of industry competitiveness

- Ford fell into the middle tier of advertisers in terms of clicks. We could also see if they remain a middle-tier advertiser when this metric is changed to ad spend. An advertiser’s tier is important for providing a realistic benchmark for current performance. It also lets an advertiser see what it would take to move into a higher tier.

- Ford’s average ad rank was 3.6, not bad for getting clicks, but not a dominant position. (Wonder what GM got during the same period?)

- When we compared Ford’s metric to that of the Industry Leader, we see a higher CTR (great), a higher CPC (not as great), and a significantly lower number of total clicks.

- Ford’s monthly spend is estimated to be between $1.5 million and $2.8 million

- The two pie charts shows that Ford spends two-thirds of its budget on keywords in the Cars & Trucks category, but only gets around half of its clicks from those ads.

What We Learned: Rank Knock Out

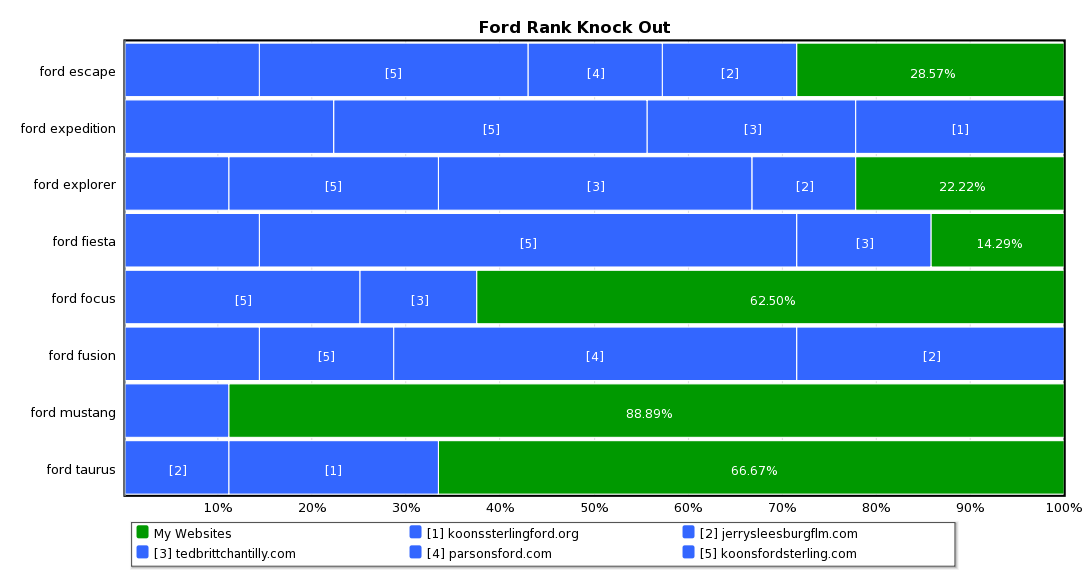

The next chart we looked at was our Rank Knock-Out Chart. It shows the percentage of time that an advertiser occupies the top rank for different keywords. For example, Ford (the brand itself, not any of its dealers) was seen in the top position for the keyword ‘ford escape’ 29% of the time during our monitoring period. Looking across the row reveals the other advertisers who also occupied the top spot. A quick scan reveals that a Ford Dealer (Koon’s Ford from Sterling, VA) was in the top spot approximately the same percentage of the time — see the cell labeled [5]. Note: This analysis was performed from just one IP address in Virginia which explains the prevalence of these dealers. We can easily perform for additional geographies as well. A few things that caught our eye:

- Ford dominated the top spot for its Focus and Mustang keywords, with 63% and 89% figures, respectively

- On the flip side, Ford was never in the top spot for its Expedition and Fusion models. Whether this is good or bad, planned or unplanned, only Ford’s SEM Managers would know for certain

Want to Learn More About Automotive Advertising?

Contact us for an analysis of other advertisers in this industry. We are happy to show you a demo of what we know. Analysis Performed By The Search Monitor

- Verticals: Vehicles > Motor Vehicles (as well as one of our Custom Monitoring Campaigns)

- Keyword Groups Analyzed: Cars and Trucks

- Dates Analyzed: September 3 – 5, 2014

- Metrics Analyzed: Trademark Bidding & Violations, Vertical Spend, Rank Knock Out

- Engines Analyzed: Google in the US (see other sites and countries we monitor)

- Source: Our vertical-focused Lighthouse tool and our competitive monitoring platform

Share on Social

See Our Data at Work

Provide us with a competitor’s website, a set of keywords, or one of our 1,000+ verticals, and we’ll show you the power of our monitoring capabilities. Request a personalized demo today and see what our insights can do for you!

Trusted by

Brand Protection

Brand Protection SEM Insights

SEM Insights Affiliate Compliance

Affiliate Compliance Ad Armor

Ad Armor Learning Center

Learning Center Guides & Webinars

Guides & Webinars We Love Data™

We Love Data™ About Us

About Us Our Data

Our Data Careers

Careers Our Team

Our Team News

News Contact Us

Contact Us