Jump to section

We LOVE Data: Amazon vs Walmart vs Target

Back to School Season is upon us – which means it’s time to shop for clothes!

We picked the apparel space for this analysis because it presented the opportunity to study a vast variety of keywords and brands. This space faces a lot of competition from resellers and brand manufacturers – which makes it tough to dominate. We track all of this with sophisticated crawlers and deep ad copy reporting tools!

We were curious to see how Amazon, Walmart, and Target stack up as far as reach and affiliate strategies.

Our findings amazed us. We revealed not just a fight BUT a genuine beat down! Amazon destroyed this space with an impressive reach that is 12x greater than Target and 6x the size of Walmart. The most mind-blowing part is how Amazon used an unconventional strategy to dominate: Affiliate direct linking!

Here is what we found:

We Love This Data… Why?

-

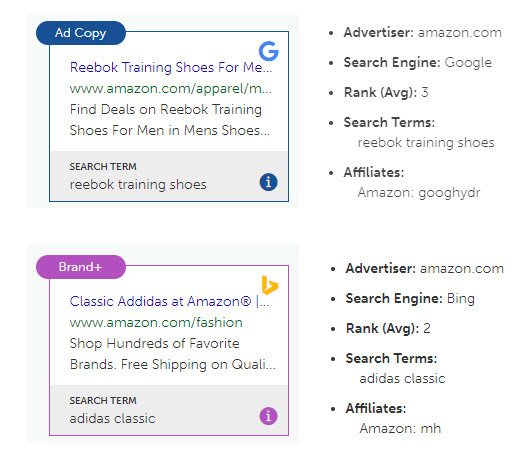

- Amazon’s Dominant, Unique Strategy. Amazon crushed Walmart and Target in reach. The most mind-blowing part is that Amazon used an unconventional strategy to dominate by empowering its affiliates to direct link. Direct linking affiliates comprise 99% of Amazon’s reach! Look at these ads – all are affiliates!

-

- We Learned That Amazon Spends 1% of What we think. Amazon’s direct linking affiliate strategy causes their ads to literally show up on every product keyword. This makes you think that they are spending $20 – $30 million dollars/month on paid search. What we found is that Amazon actually only spends ad dollars on its own brand name, while their domineering ads on brands that they sell are cleverly paid for by Amazon’s direct linking affiliates.

- Walmart’s Coordinated Strategies Worked Great Too! Walmart’s strategy is a nice mix of running a strong search presence with its own ads coupled with incentivizing affiliates to promote Walmart on their landing pages. Walmart’s coordinated strategy nearly split their reach 50/50 between their own ads and affiliates. Despite trailing Amazon, half of Walmart’s reach coming from affiliates, accounted for them having twice the reach of Target.

- Prevalence of Affiliates. We were amazed by such a high prevalence and importance of affiliate usage. Amazon and Walmart generated the majority of their reach from affiliates while Target was trailing in reach due to its lack of affiliate use. We wonder… Why doesn’t Target utilize affiliates in its search channel strategy?

About this Research

We LOVE Data™ is a research series published by The Search Monitor to provide industry insights for online advertising activity on search engines and other online marketing channels.

About The Search Monitor

The Search Monitor provides real-time competitive intelligence to monitor brand and trademark use, affiliate compliance, and competitive advertisers on paid search, organic search, local search, display ads, mobile, and shopping engines worldwide.

Thousands of interactive agencies, search marketers, and affiliate marketers use The Search Monitor to track ad rank, ad copy, keyword reach, click rates and CPCs, monthly ad spend, market share, trademark use, and affiliate activity.

We provide the most precise data possible through hourly crawling from thousands of global IP addresses, and advanced algorithms. All data are available through easy-to-use web-based reports and automatic alerts that can be customized for your vertical.

Benchmark yourself against the industry leaders and stay one step ahead of the competition by contacting us and requesting free competitive insights about your industry.

Share on Social

See Our Data at Work

Provide us with a competitor’s website, a set of keywords, or one of our 1,000+ verticals, and we’ll show you the power of our monitoring capabilities. Request a personalized demo today and see what our insights can do for you!

Trusted by

Brand Protection

Brand Protection SEM Insights

SEM Insights Affiliate Compliance

Affiliate Compliance Ad Armor

Ad Armor Learning Center

Learning Center Guides & Webinars

Guides & Webinars We Love Data™

We Love Data™ About Us

About Us Our Data

Our Data Careers

Careers Our Team

Our Team News

News Contact Us

Contact Us